The Zimbabwe Revenue Authority (ZIMRA) has given companies, individuals and any other entities that have vehicles that were not properly cleared through the country’s tax collector a reprieve to regularise the clearance and registration by 15 December 2023 after which they will be liable to forfeiture.

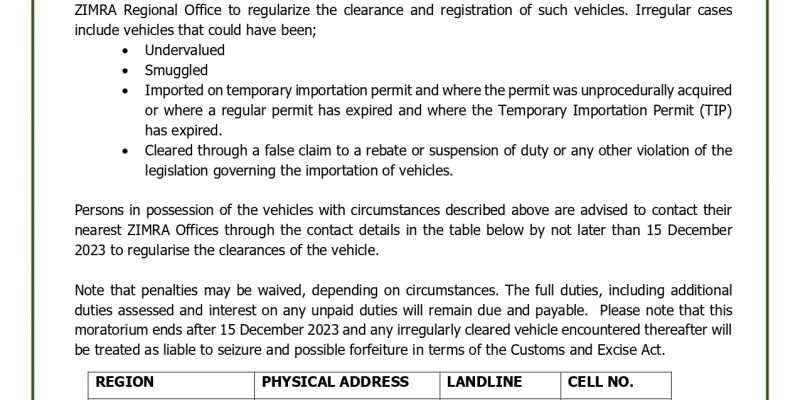

In a statement, ZIMRA noted several irregular scenarios that include vehicles that were undervalued, smuggled, or imported on temporary importation permits and where the permit was unprocedurally acquired or where a regular permit has expired and where the temporary importation permit has expired.

Some of the cars could have been cleared through a false claim to a rebate or suspension of duty, or any other violation of the legislation governing the importation of vehicles.

The country’s tax collector also made it clear that penalties may be waived depending on the situation.

“Note that penalties may be waived, depending on circumstances.

“The full duties, including additional duties assessed and interest on any unpaid duties will remain due and payable.

“Please note that this moratorium ends after 15 December 2023 and any irregularly cleared vehicle encountered thereafter will be treated as liable to seizure and possible forfeiture in terms of the Customs and Excise Act,” read the statement.

In 2019, the government introduced a motor vehicle rebate scheme in which civil servants who have served for 10 years and above can import vehicles without paying import duty.

The scheme has, however, been abused with several individuals including ZIMRA officers stationed at different border posts being arraigned before the courts for different fraud and money laundering charges. Some have even gone to the extent of using forged civil service letters to import vehicles for resale, a move which has been short-changing the country.

Comments