The national statistics agency, ZimStat has praised Reserve Bank of Zimbabwe (RBZ) Governor Dr John Panonetsa Mangudya for his New measures bearing fruit as inflation dropped in a record over five consecutive months. This month alone, Monthly inflation fell to 1,8 percent, its lowest since April last year and the second lowest for more than three years, as the market-led and effective policy interventions by the Reserve Bank of Zimbabwe continue to succeed in holding prices down.

This has given even more cheer to hard-pressed consumers, seeing the fall in monthly inflation led by food prices according to ZimStat, the national statistics agency, with food on average rising just 0,9 percent overall in price as the price cuts and slight increases almost balanced out. Monthly inflation rose gradually but steadily in the last half of last year and the first quarter of this year after being beaten back following the surge seen just before the audacious trailblazing foreign currency auction system Governor Mangudya introduced and other measures killed off the black market pricing in the middle of 2020.

Inflation suddenly shot up to peak at 30,7 percent in June, before the Government and Reserve Bank launched a swathe of measures to smash the speculation that was driving up the black market exchange rate and which in turn was driving inflation. They worked. The measures were anchored around pushing up interest rates to 200 percent, so speculators could not make money by borrowing to play the black market. At the same time, a number of measures were taken to take ordinary businesses out of the black market, from selling gold coins to those that wanted a legal store of value, introducing the interbank market run by the banking system to set the official exchange rate. The result has been rapidly growing stability. The latest slowdown in the pace at which prices have been going up represents the fifth consecutive month the monthly inflation rate has trended down from its June peak, with Treasury having projected it to close the year well below 3 percent, a target already beaten a month early.

“The month-on-month Food and Non-Alcoholic Beverages inflation rate stood at 0,9 percent in November 2022, shedding 2,2 percentage points on the October 2022 rate of 3,1.”

ZimStat added, ”The month-on-month non-food inflation rate stood at 2,6 percent, shedding 0,6 percentage points on the October 2022 rate of 3,2 percent,”

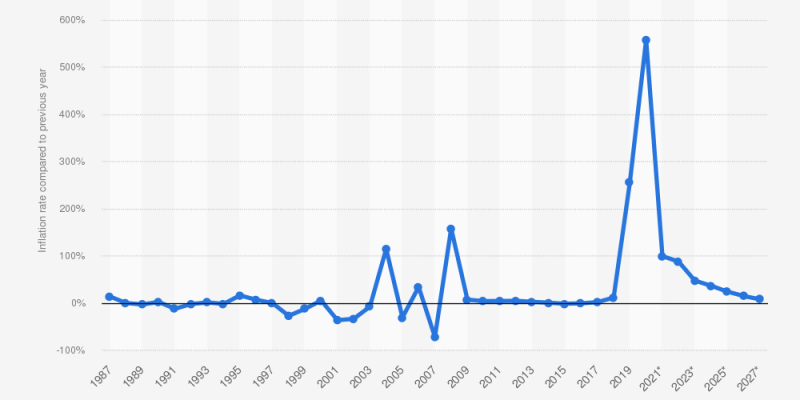

ZimStat, further revealed on a year-to-year basis, inflation cooled down to 255 percent in November from 268,8 percent in October and 280,4 percent in September 2022. This will continue to inch down each month as the latest month has a lower monthly inflation that the same month a year earlier, and then in the second quarter of next year it will suddenly plunge as the high monthly figures of that time this year are removed from the calculations.

RBZ Governor Dr Mangudya’s interventions he introduced as the Apex bank final monetary and fiscal authority entailed raising the bank policy rate, which determines the minimum bank lending rates from 80 to 200 percent to stymie speculative borrowing. This came after Dr Mangudya discovered that speculative activities in the economy, to exploit arbitrage opportunities, included illegal trading in currency and stocks on the Zimbabwe Stock Exchange, which drove exchange rate volatility and inflation. Higher interest rates have made borrowing to finance speculative activities expensive and unprofitable while the value for money audits on all public contracts and rationalisation of payment modalities thereof, have cut the flow of excess liquidity into the market, which drove exchange rates and inflation.

Measured monthly or yearly, INFLATION represents the rate at which prices either go up or decrease over the measured period. A decline in the rate, however, does not necessarily signify falling prices but the reduced pace at which prices are rising. The data for the latest inflation figures were collected from November 10 to 16, 2022. Zimbabwe’s inflation hit a post-dollarisation peak of 837,5 percent in July 2020, before a coterie of policy interventions saw it slump to a two-year low of 50,1 percent in June last year.

Comments